With over 300 energy generation units signed up with Elexon in the UK operating as balancing parties and many more to be added to close the energy gap, there will be increasing complexity in managing generation trading and settlement, particularly if the electricity balancing regime moves to locational marginal pricing, making the current relatively simple settlement system redundant.

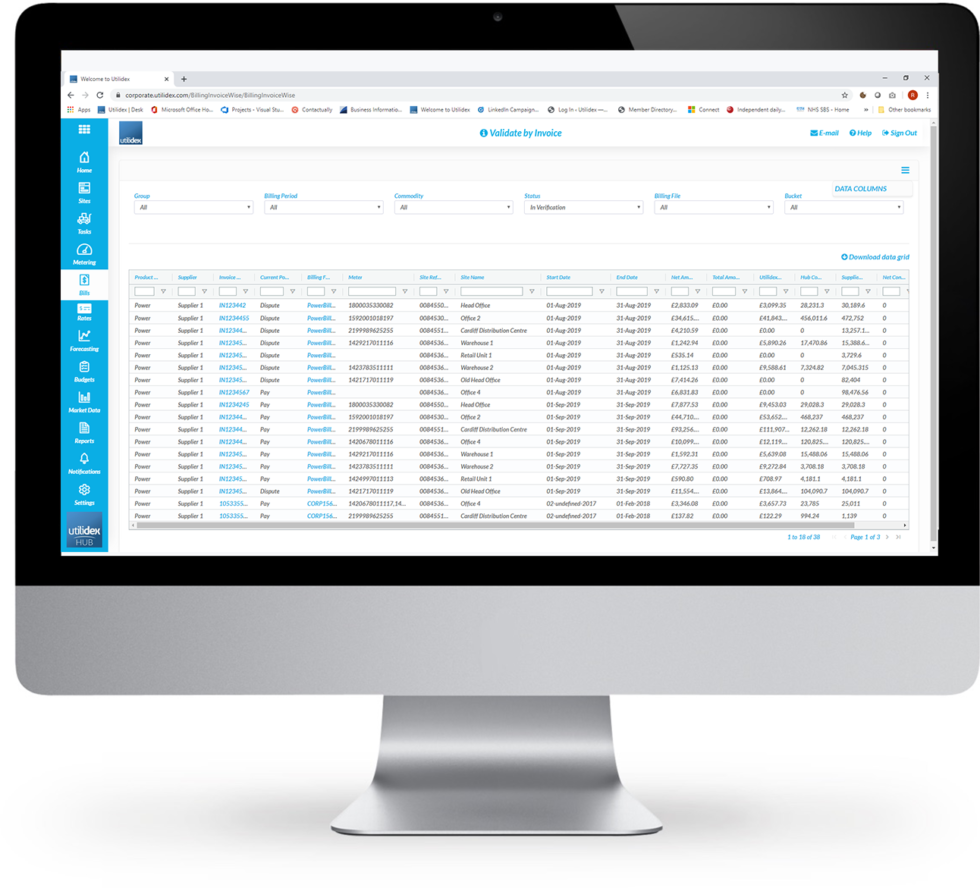

Further, there are also many thousands of embedded generators too small for Elexon and National Grid to recognise that will have a significant role in reducing the demand-supply gap. Currently, these alongside the smaller generation units supporting the balancing mechanism are often operating using spreadsheets, creating a cottage industry of manual activities which could be streamlined along the same lines as automated industrial and commercial billing and validation.

The benefits of automating this include reducing manual effort and general data management activities across 1000s of sites, reducing the potential friction between generator and off-taker and creating a regime of precise billing at the first time of asking.

Whilst investment in energy generation has never been so diverse; there is now an excellent opportunity for asset owners/investors to compel their counterparties to automate the settlement process and provide transparency.

At Utilidex, our integrated system provides a time-saving solution and makes your energy life easier.

What key metrics are incorporated into the Utilidex system?

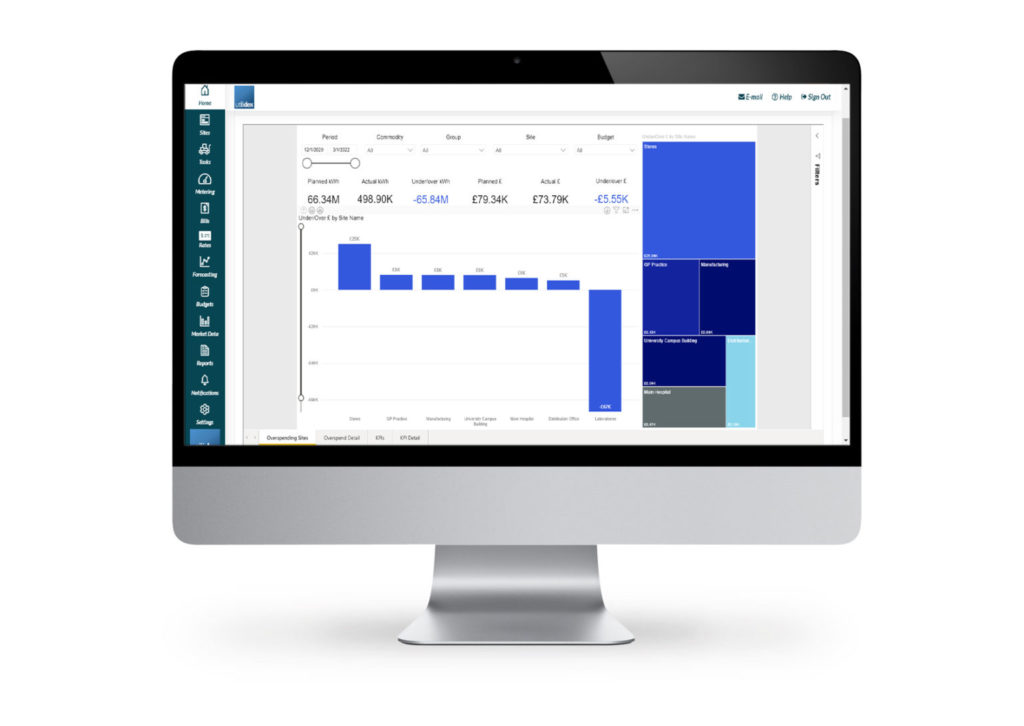

- These include incorporating a View of Settlement Exposure & MtM (Mark to Market) Values categorized by Counterparty

- Allows customers to see settled/unsettled trades & MtM value at a summary level in the system to understand their exposure and minimise collateral costs

- Creates a detailed and concise report that clearly outlines their transaction costs versus benchmarked market data irrespective of the trade time horizon

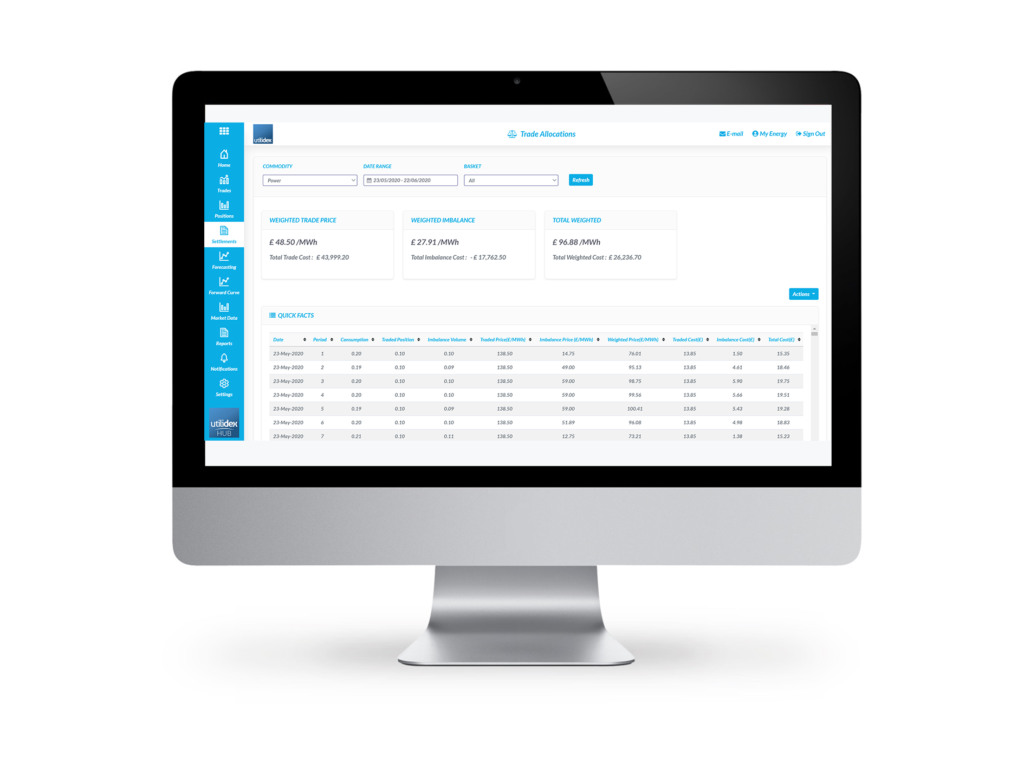

Truing up trades/imbalance calculations through settlement on a single software platform will enable a reduction in direct costs and improve the accuracy of settlement between generation/ asset owner and their counterparty/ route to market.

Further, the sale of a commodity (i.e. gas, power, carbon etc.) is often made via a line of credit, where payment/collateral is posted sometime prior to delivery. These sales transactions bear risk, requiring a Settlement and Counterparty Exposure calculation to manage counterparty risk and reducing the cost of collateral management as mark-to-market positions fluctuate. The Utilidex Risk Management system enables customers to track their exposure and determine their MtM value, a key index for calculating Risk Measures.

With the increase in energy prosumer participants, the need to financially settle as accurately as possible and manage counterparty risk can only really be done quickly and effectively using a software platform.

If you are interested in an integrated smart system to identify and evaluate the counterparty risk and exposure, please do not hesitate to contact us. At Utilidex, we have experienced teams to provide tailored services for you to design the right platform. Request a demo today to see how our solutions can help your organisation improve efficiency.